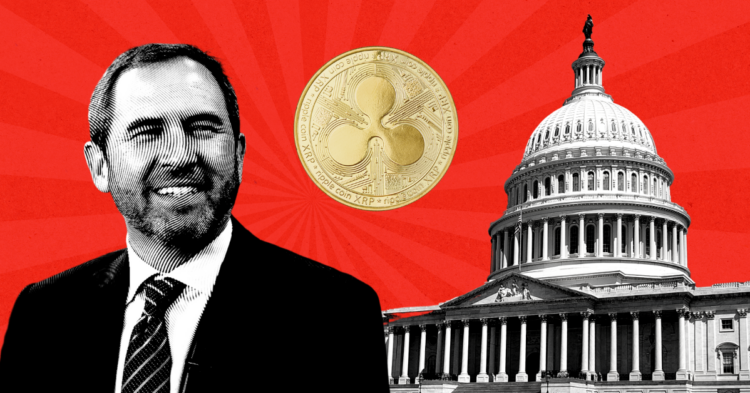

Ripple’s CEO, Brad Garlinghouse, recently provided valuable insights for the XRP community, painting a picture of both optimism and caution. In a detailed interview, he shed light on promising developments surrounding the launch of Ripple’s RLUSD stablecoin, while also addressing the regulatory hurdles the company continues to face, particularly in the United States.

Ripple’s RLUSD Stablecoin Is Almost Here

Ripple is on the brink of launching its new stablecoin, RLUSD, which will be pegged to the U.S. dollar. During his recent interview, Garlinghouse confirmed that the stablecoin is expected to launch soon, pending the final nod from U.S. regulators. Although Ripple is initiating the launch in the U.S., the company is also exploring opportunities in other regions such as Japan, where regulatory frameworks are more crypto-friendly.

Garlinghouse explained that the stablecoin is integral to Ripple’s strategy to tap into the burgeoning global demand for stablecoins. He believes that RLUSD will be a crucial addition to Ripple’s suite of offerings, helping to fortify its presence in the global marketplace.

Why Ripple Is Entering the Stablecoin Market

While XRP has long been the cornerstone of Ripple’s cross-border payment solutions, the decision to venture into the stablecoin market signifies a strategic expansion for the company. Garlinghouse highlighted that the stablecoin market is anticipated to grow tremendously in the coming years, potentially reaching a valuation of trillions of dollars. By entering this market, Ripple aims to cater to the escalating demand and bolster its standing in the financial sector.

Ripple’s foray into stablecoins reflects its ambition to remain at the forefront of the evolving cryptocurrency landscape, offering a broader array of options to its customers.

Ripple’s Success in Japan

Garlinghouse underscored Ripple’s fruitful partnerships, especially in Japan. Since 2016, Ripple has collaborated closely with SBI Group, a major financial conglomerate in Japan. These partnerships have been instrumental in increasing the adoption of XRP in Japan.

Garlinghouse commended Japan for its progressive stance towards cryptocurrency, contrasting it with the slower regulatory progress in the U.S. He believes that Japan’s supportive regulatory environment can drive innovation and open new avenues for Ripple.

Challenges in the U.S. Crypto Market

Despite the favorable developments, Garlinghouse did not shy away from discussing the regulatory challenges Ripple faces in its home market. He criticized the U.S. government’s approach to crypto regulation, describing it as hostile and outdated. In particular, he pointed to the ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), which has cast a cloud of uncertainty over the entire industry.

Nonetheless, Garlinghouse remains resolute in his commitment to making cryptocurrency a bipartisan issue. He urged regulators and policymakers to assess blockchain technology impartially, without the influence of partisan politics. This balanced perspective, he hopes, will pave the way for a more favorable environment for crypto innovation in the U.S. in the future.