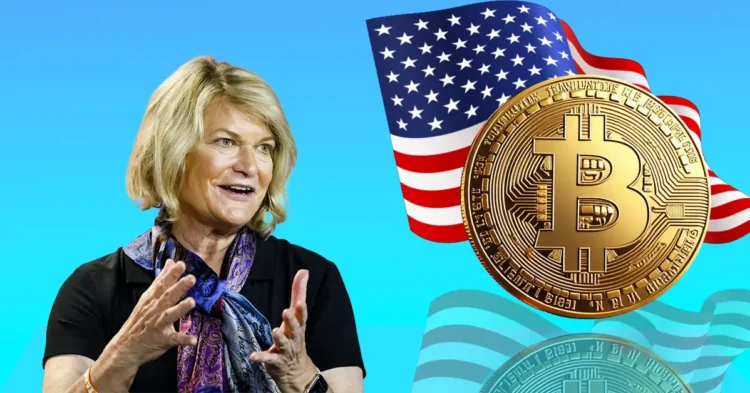

U.S. Senator Cynthia Lummis, often referred to as the “Crypto Queen,” is championing an ambitious initiative: the establishment of a Bitcoin reserve for the United States. Lummis envisions this strategic move as a catalyst for enhancing the American economy by positioning Bitcoin as a novel financial asset. However, the question remains—does Bitcoin possess the stability required for such a significant role? Let’s delve into her proposal and examine the potential challenges it may encounter.

Bitcoin vs. Gold: Evaluating Bitcoin’s Reliability

Historically, the United States has relied heavily on its extensive gold reserves to underpin the stability of the dollar. With over 8,000 tons in reserve, the U.S. boasts a gold stockpile that surpasses that of most nations. Gold’s consistent value and liquidity make it a reliable foundation for the dollar. In contrast, Bitcoin presents a unique set of challenges. Its value is notoriously volatile, with prices capable of soaring or plummeting within a single day. The proposed $200 billion Bitcoin reserve would represent only a small fraction of the current gold reserve’s value. The critical question is whether Bitcoin can eventually mirror gold’s reliability in the financial landscape.

Potential Pathways for U.S. Bitcoin Acquisition

To initiate the process, the administration, under the leadership of President Trump and Senator Vance, could potentially employ an executive order. This would facilitate initial Bitcoin purchases by bypassing the usual lengthy approval processes associated with traditional currency acquisitions. This strategy is akin to the government’s use of the emergency oil reserve in 2022 to mitigate gas prices. Treating Bitcoin as a “strategic asset” could circumvent some bureaucratic hurdles. However, for a sustained Bitcoin reserve strategy, Congressional approval and multi-year funding would likely be necessary. Convincing Congress, particularly those members who are skeptical of cryptocurrency, poses a significant challenge. It’s noteworthy that the U.S. government currently holds 208,109 BTC, valued at approximately $15.66 billion at the time of writing, along with other major cryptocurrencies seized from various cases.

The Road Ahead: Anticipating Future Developments

Senator Lummis’s proposal is undeniably ambitious, but securing its approval is no small feat. Bitcoin’s reputation for volatility and risk remains a significant concern, and many members of Congress may view it as an unstable candidate for a national reserve. With inflation continuing to be a pressing issue, the government may exercise caution before integrating Bitcoin into its reserves. While the concept of a national Bitcoin reserve is likely to spark intriguing debates, substantial changes may not be imminent. Nonetheless, it remains an area to watch closely, as Bitcoin’s role in shaping America’s financial future could be transformative.

“`

This enriched content is designed for SEO compatibility, offering a comprehensive and engaging exploration of Senator Lummis’s Bitcoin reserve proposal.