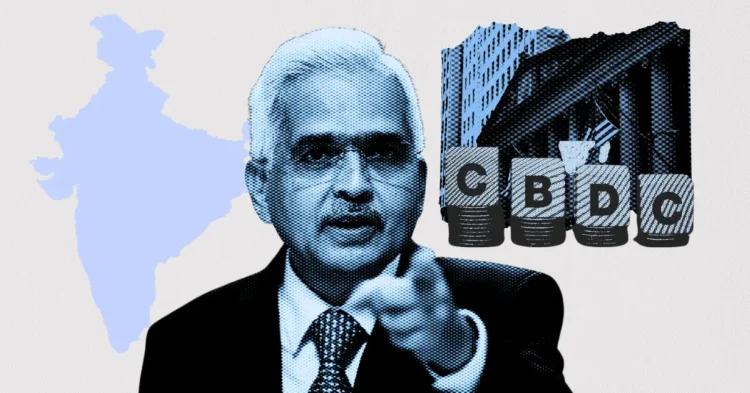

In a significant move towards modernizing its financial system, India is preparing to introduce the digital rupee, a Central Bank Digital Currency (CBDC). This initiative is set to usher in a new era in Indian finance, promising to transform the economy profoundly. The retiring Governor of the Reserve Bank of India (RBI), Shaktikanta Das, has articulated a compelling vision of how this digital currency could revolutionize the nation’s economic landscape.

Das’s Push for Digital Rupee

In his farewell address on December 10, Shaktikanta Das expressed his confidence in the digital rupee’s potential to revolutionize payment systems. His foresight envisions a future where digital currency could gradually take the place of traditional paper money, leading to a more streamlined and efficient transaction system. The Reserve Bank of India has already embarked on this transformative journey by initiating pilot projects, positioning India as a trailblazer in the development of CBDCs.

Das proudly highlighted the RBI’s pioneering role, stating, “RBI, among the central banks, is a pioneer.” While many global counterparts are still in the experimental stages of digital currency development, the RBI has already launched a pilot project for the digital rupee, showcasing India’s commitment to financial innovation.

Careful Approach Towards CBDCs

Despite his enthusiasm for the future of CBDCs, Das advocated for a cautious and measured approach to their implementation. He emphasized the necessity of conducting comprehensive research before deploying a digital currency nationwide. According to Das, CBDCs hold immense potential not only for domestic payments but also for facilitating cross-border transactions. The RBI is actively expanding its payment platform, collaborating with countries such as Sri Lanka, Bhutan, and Nepal to enhance international financial connectivity.

Global Implications of the Digital Rupee

The digital rupee’s introduction is not just a national endeavor but has significant global implications. As India takes strides towards digital currency, it sets a precedent for other countries considering similar initiatives. This move could potentially alter the dynamics of international trade and finance, offering a more efficient and transparent alternative to existing systems.

New Leadership, New Directions

With the appointment of Sanjay Malhotra as the new RBI governor, there is heightened anticipation regarding the future of India’s monetary policy. As the nation grapples with challenges related to inflation and economic growth, Malhotra’s leadership will be pivotal in determining the trajectory of the digital rupee and the broader financial evolution of India.

Stay Informed on the Latest Financial Trends

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Never miss a beat in the crypto world as India embarks on this exciting journey towards embracing digital currency.