In the ever-evolving world of cryptocurrency, gaining a deep understanding of market behavior is crucial for both seasoned investors and newcomers. A recent analysis by CryptoQuant analyst tugbachain has illuminated a vital aspect of the Bitcoin market—the UTXO Realized Price Age Distribution. This metric offers key insights into the holding patterns of various investor groups and their responses to market price fluctuations.

The Significance of Realized Price

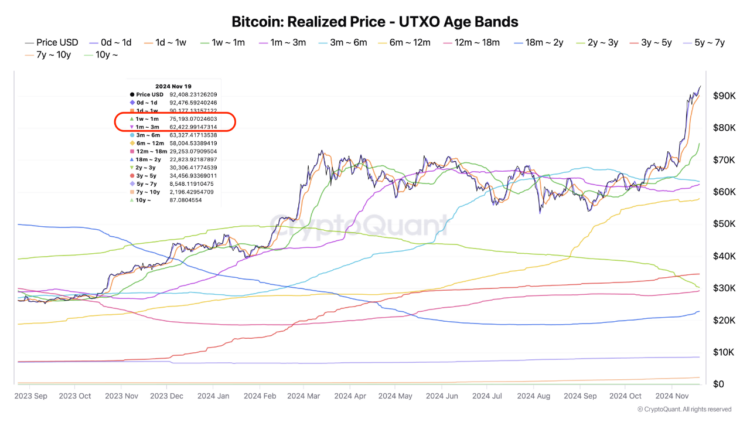

The realized price is a fundamental concept in cryptocurrency, calculated by dividing the Realized Cap by the total supply of Bitcoin. It serves as a critical tool for identifying the cost bases of long-term holders as well as recent buyers. According to tugbachain’s analysis, the realized price levels for one-month and three-month periods are often pivotal during corrections in bull markets. These price levels offer valuable insights into market sentiment, especially among smaller investors, and shed light on the dynamics driving buying and selling activities.

Key Support Levels for Bitcoin

Identifying key support levels is essential for understanding market behavior. In the case of Bitcoin, analyst tugbachain has identified two specific realized price levels—$75,100 and $62,400—as crucial cost bases for smaller investors. These levels act as support zones during periods of market volatility, often triggering buying reactions when Bitcoin’s price tests these thresholds. Such reactions underscore the psychological and financial influence of these price points on smaller investors.

Moreover, these support levels not only reveal the patterns of small investors but also demonstrate how their actions can be influenced or manipulated in a bull market. Bullish cycles frequently amplify fear among smaller investors, leading to panic selling. Therefore, monitoring these levels closely can provide valuable insights for making informed investment decisions.

Analyzing Bitcoin’s Market Performance

Amidst the dynamic shifts in the cryptocurrency landscape, Bitcoin has recently reached a renewed all-time high (ATH). At its peak, Bitcoin stood at $94,784. However, at the time of writing, the asset has retraced slightly, with a current trading price of $94,523, still marking a 3.1% increase in the past day.

The consistent upward momentum of Bitcoin in recent weeks has prompted CryptoQuant to share an intriguing analysis on whether it is time to sell or hold BTC. This analysis, shared on their official X account, examines key metrics, including Bitcoin’s Market Value to Realized Value (MVRV) ratio.

Is It Time to Sell or Hold Bitcoin?

According to CryptoQuant, an MVRV ratio greater than 3.7 has historically signaled market tops for Bitcoin. Fortunately, the latest data indicates that Bitcoin’s MVRV ratio remains below this level, standing at 2.62 as of November 19. This suggests that the market may still have room to grow before reaching its peak.

For investors seeking to make informed decisions, exploring additional key metrics is essential to understanding market timing. By delving into these insights, investors can navigate the complexities of the cryptocurrency market more effectively.

“`

This HTML document provides a detailed and enriched overview of Bitcoin’s market behavior and key insights from CryptoQuant’s analysis, while also enhancing the readability and SEO compatibility of the content.