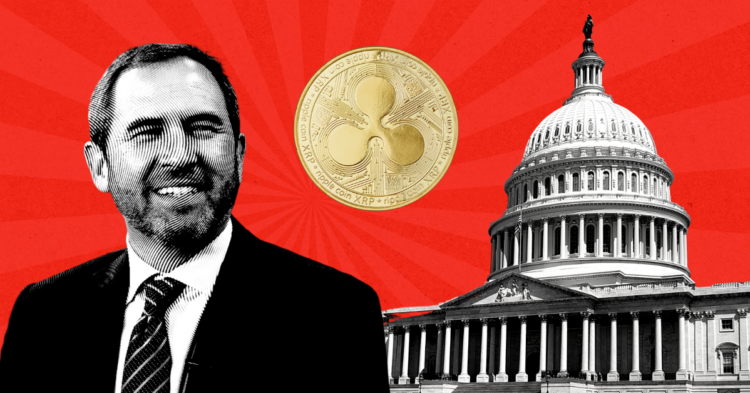

XRP, the cryptocurrency developed by the digital payment network Ripple, has been experiencing significant growth over the past few days. With a market valuation hovering around $11 billion, Ripple is ambitiously attempting to propel XRP into the mainstream by launching its own Exchange-Traded Fund (ETF). However, the company faces a significant hurdle in the form of a protracted legal battle with the U.S. Securities and Exchange Commission (SEC), which has been a major impediment to the ETF’s launch. In a recent interview with BBC, Ripple’s CEO shed light on his strategic crypto checklist that was communicated to Donald Trump during his initial 100 days in office.

A War Against Crypto

During the interview, the Ripple CEO was asked about the key issues he wanted Trump to address. He pointed out that Trump has recently positioned himself as a pro-crypto President and an advocate for the digital currency sector. One of Trump’s early promises, as recalled by the CEO, was to terminate Gary Gensler, whom he accused of leading a “war against crypto” in the United States.

The CEO emphasized that nations like the UK, Singapore, and Switzerland have adopted more favorable stances towards cryptocurrency by establishing clear regulations. This approach has encouraged both entrepreneurs and capital to flow into these regions, fostering growth and innovation within the crypto industry.

XRP Not A Security- The Law of the Land

In the ongoing battle with the SEC, the Ripple team has been engaged for over three and a half years. They celebrated a significant victory last summer when a judge explicitly ruled that XRP is not a security. Although the SEC is appealing parts of this decision, they are notably not challenging the ruling that XRP is not a security.

The CEO expressed confidence in this outcome, noting that the judicial decision establishes that, according to U.S. law, XRP is not considered a security. However, he also voiced frustration over the lack of regulatory clarity for other cryptocurrencies like Ethereum (ETH) and Solana, which continue to face regulatory challenges. He described the necessity to litigate each token separately as ‘maddening’ and highlighted the industry’s eagerness for the SEC to establish clear regulatory guidelines, drawing parallels with the well-defined taxonomies in the UK and Japan.

What is The Key Change Brad Expects?

The CEO underscored that the SEC, under Gensler’s leadership, has attempted to classify most cryptocurrencies as securities. He elaborated that securities typically imply rights and ownership within a company, citing that owning a security in Apple means holding a stake in the company—an analogy that does not apply to cryptocurrencies. He emphasized the urgency for regulatory clarity, stating that the SEC should not aim to dominate the crypto industry.

Furthermore, he criticized the SEC’s approach of regulation through enforcement rather than through the establishment of clear, codified rules. This, he argued, hampers the industry’s growth and creates uncertainty for market participants.

“`

This version of the content is expanded, enriched with HTML tags for better SEO compatibility, and structured for improved readability and engagement.