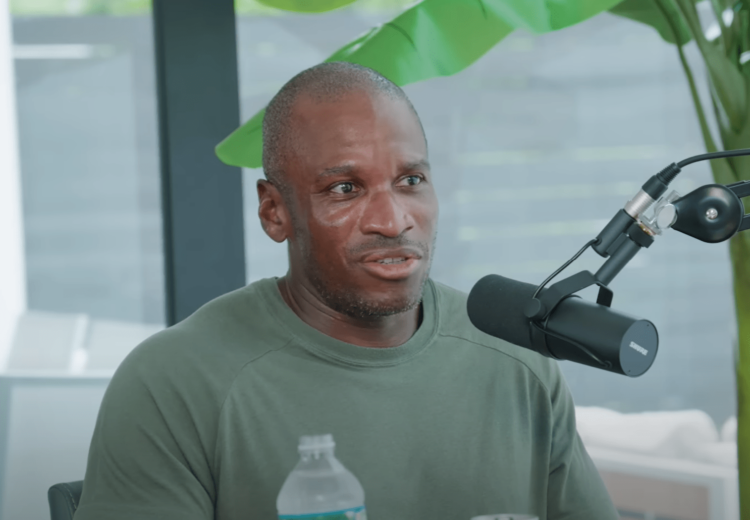

In a compelling new essay released on Monday, Arthur Hayes, a prominent digital asset investor and former CEO of BitMEX, argues that the cryptocurrency market is set for a robust rally in the first quarter of 2025. He anticipates the market will peak by mid to late March. The essay, titled “Sasa,” provides an in-depth analysis of several macroeconomic factors, including US Federal Reserve policies, balances in the US Treasury General Account (TGA), the Fed’s Reverse Repo Facility (RRP), and political uncertainties brewing in Washington.

A Metaphor from Japan’s Hokkaido and the Crypto Market

Hayes begins his essay with a vivid description drawn from Japan’s Hokkaido ski resorts, comparing the dangerous conditions caused by insufficient snow cover over sharp bamboo grass (sasa) to potential market challenges that might impede crypto rallies. As 2025 begins, Hayes notes the heavy snowfall in Hokkaido as a metaphor for a liquidity “dumping” that could drive digital asset prices higher. However, he cautions that the political and fiscal climate in the United States could present unforeseen obstacles.

Why March Could Mark The Next Peak For Crypto

“As we enter 2025, the crucial question for crypto investors is whether the Trump pump can sustain its momentum,” Hayes writes, referring to the initial optimism surrounding President Donald Trump’s second term. While Hayes admits that high expectations for policy actions from Trump’s administration might set the market up for disappointment, he believes that any short-term negativity could be mitigated by a significant “dollar liquidity impulse.”

The Role of the Fed’s Reverse Repo Facility

Hayes highlights the critical role of the Fed’s RRP in shaping Bitcoin’s price trajectory. Since the third quarter of 2022, the unwinding of this facility has correlated positively with crypto and equities prices. “Bitcoin bottomed in Q3 2022 when the Fed’s RRP reached its peak,” he elaborates. He credits US Treasury Secretary Janet Yellen’s strategy of shifting from longer-dated coupon bonds to shorter-dated T-bills for effectively draining over $2 trillion from the RRP, thereby injecting liquidity into global markets.

Liquidity Dynamics and Market Impacts

With the RRP dwindling to near zero, the Fed has “belatedly adjusted the policy rate of the RRP” to make it less attractive, according to Hayes. He notes that this adjustment still holds the potential for a $237 billion market injection once the remaining RRP funds move into higher-yielding Treasury bills. Concurrently, ongoing quantitative tightening (QT) is extracting $60 billion per month, totaling $180 billion from January to March. The net effect is a $57 billion liquidity injection over the quarter.

The Significance of the Treasury General Account

Another focal point in Hayes’s thesis is the Treasury General Account. With debt ceiling negotiations looming, the Treasury’s inability to issue new debt implies it can only fund expenses by depleting the TGA—an action that unleashes liquidity. “The aggregate amount of debt cannot rise until the US Congress increases the debt ceiling, so the Treasury can only utilize funds from its checking account, the TGA,” Hayes explains, noting that the current balance is approximately $722 billion.

Potential Political Stalemate and Its Implications

He predicts that without a debt ceiling resolution, the TGA could be exhausted by May or June. For the crypto markets, the crucial aspect is the timing of a congressional agreement. The essay underscores Trump’s narrow majority and suggests that Republicans, who position themselves as fiscally conservative, are unlikely to grant quick or easy consent. Democrats, Hayes adds, are also unlikely to support increased spending for a president they oppose, intensifying legislative brinkmanship.

March: A Critical Juncture for Liquidity and Market Expectations

Hayes’s calculations suggest TGA drawdowns could release an additional $555 billion from January through March. When combined with the $57 billion net liquidity from the Fed’s RRP and QT adjustments, total dollar liquidity could rise by as much as $612 billion in the first quarter. He identifies March as a pivotal moment when this liquidity surge might start to wane, coupled with the possibility that expectations for new federal spending or pro-crypto legislation from the Trump administration may not materialize on time.

Historical Market Behavior and Future Predictions

“I believe I answered the question I posed at the outset. The disappointment of unmet pro-crypto and pro-business legislation from team Trump can be offset by an extremely positive dollar liquidity environment,” Hayes asserts, emphasizing that peak liquidity might decline swiftly once the market anticipates the resolution of the debt ceiling and subsequent TGA refilling.

Bitcoin’s 2024 Price Action and Its Implications

Reflecting on historical trends, Hayes references Bitcoin’s price performance in 2024, which peaked in mid-March around $73,000, then remained stagnant and dipped just before the April 15 tax deadline. He reasons that as soon as TGA spending concludes, the net positive liquidity scenario reverts to neutral or negative, leaving risk assets exposed.

Conclusion and Market Strategy

While Hayes acknowledges that factors like Chinese credit expansion, Bank of Japan interest rate policies, and potential dollar devaluation strategies by the Trump administration could disrupt his timeline, he trusts the RRP and TGA mechanisms as reliable near-term indicators. He concludes by suggesting that historical patterns often present substantial selling opportunities in the first quarter. By springtime, investors might consider taking profits and “relaxing on the beach” while waiting for favorable liquidity conditions to reappear in the latter half of the year. “Right on schedule, just like almost every other year, it will be time to sell in the late stages of the first quarter,” Hayes concludes.

Current Bitcoin Market Conditions

At the time of writing, Bitcoin is trading at $101,344.