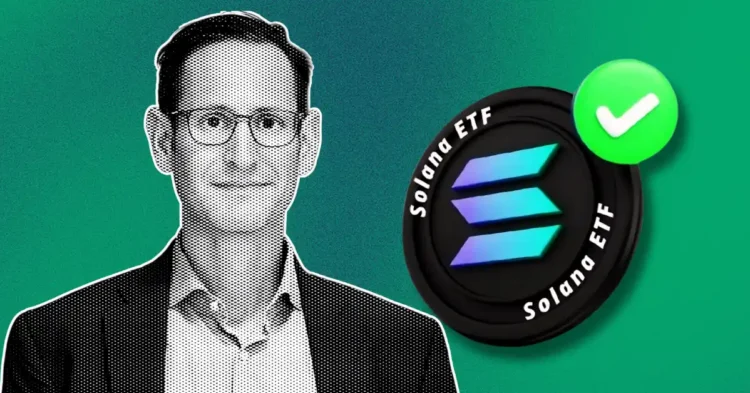

The cryptocurrency market has been abuzz with speculation ever since the successful introduction of Bitcoin and Ethereum exchange-traded funds (ETFs). Now, the spotlight is on Solana, as many enthusiasts wonder whether it could be the next big name to secure its own ETF. According to Matthew Sigel, the head of digital asset research at VanEck, the probability of a Solana ETF being approved is remarkably high. He attributes this optimism to the evolving political landscape, which is increasingly embracing cryptocurrencies.

Anticipated Approval of Solana ETF By 2025

In a discussion with the Financial Times, Matthew Sigel expressed strong confidence in the potential approval of a Solana ETF in the near future. He remarked that the likelihood of this happening by 2025 is exceptionally promising. This prediction marks a significant shift from recent years, where the Biden administration’s stringent regulatory stance impeded the progress of crypto products. Sigel believes that the current political shifts could pave the way for a Solana ETF to be sanctioned by late 2025. With VanEck and 21Shares leading the charge in Solana ETF filings slated for 2024, anticipation is mounting for the possible approval of a Solana ETF.

Divergent Views from BlackRock

However, not all industry leaders share the same enthusiasm. Robert Mitchnik, head of digital assets at BlackRock, has expressed that his company is not looking beyond Bitcoin and Ethereum, demonstrating a more cautious stance towards other cryptocurrencies such as Solana. Despite this cautious approach, the growing confidence and shifting political winds have never made the prospects of a Solana ETF look more promising.

Renewed Hopes for Solana ETF Under Trump Presidency

The idea of a Solana ETF has garnered further interest with the speculation surrounding Donald Trump’s potential return to the presidency. Many believe that his return could usher in a less restrictive regulatory environment for cryptocurrencies. Should this scenario unfold, the approval of a Solana ETF might materialize sooner than anticipated. Industry experts, such as Matt Hougan from Bitwise Asset Management, suggest that Trump’s election could significantly alter the crypto landscape, potentially easing the path for digital assets like Solana, XRP, and Litecoin to flourish.

Potential Resignation of Gensler and Its Implications

Amidst these speculations, rumors are swirling that SEC Chairman Gary Gensler might resign soon, possibly after Thanksgiving and before a potential Trump inauguration. Many within the crypto community have criticized Gensler’s stringent regulations, arguing that they have stymied the growth of crypto products like ETFs. If Gensler were to step down, it could usher in new leadership, fostering a more supportive environment for crypto innovation, which could further bolster the chances of a Solana ETF approval.

“`

This enriched content now provides more context and depth while maintaining SEO-friendly elements and a structured HTML format for better search engine visibility.